By: PR Fueled

Financial exclusion remains a significant concern in the UK, impacting numerous individuals by limiting their access to essential banking services. A notable portion of the adult population is classified as “underbanked,” lacking full access to mainstream banking services. This situation can create various financial challenges and obstacles, influencing their day-to-day financial activities and overall financial well-being.

What is Financial Exclusion?

Financial exclusion occurs when individuals or communities are unable to access necessary financial services, such as bank accounts, loans, and credit. This exclusion can be due to various factors, including poor credit ratings, lack of proof of a current UK address, or being new to the country. Despite efforts to increase financial inclusion, a substantial number of people remain unbanked or underbanked, facing what is known as the “banking poverty premium.”

The Banking Poverty Premium

The banking poverty premium refers to the additional costs incurred by those without access to banking services. According to The Guardian, unbanked individuals in the UK could pay up to £485 more annually for basic services and bills. This premium arises because discounts and the right deals are often only available to those who can pay via direct debit or have access to credit.

For example, individuals with a bank account might pay around £1,118 per year for gas, electricity, mobile phones, broadband, and interest payments on a £300 loan spread over 52 weeks. In contrast, those without a bank account could end up paying £1,603 for the same services. This significant difference underscores the financial strain experienced by the underbanked population.

Who Are the Highly Affected?

A government report on financial inclusion highlighted that 18-24 year olds and the unemployed are the likely to be affected by the lack of access to banking. Migrants and individuals with poor credit ratings also face substantial challenges in opening and maintaining bank accounts. These groups are often left out of the financial system, making it difficult for them to manage their finances effectively.

The Impact of Being Underbanked

Being underbanked has far-reaching implications. Without a bank account, individuals cannot take advantage of direct debit discounts, which are commonly linked to lower rates for utilities and other services. Additionally, they lack access to affordable credit options, making it harder to cover unexpected expenses or invest in significant purchases. This exclusion perpetuates a cycle of financial instability and hardship, as the underbanked are forced to rely on costly alternatives.

Suits Me®: A Practical Solution to Financial Exclusion

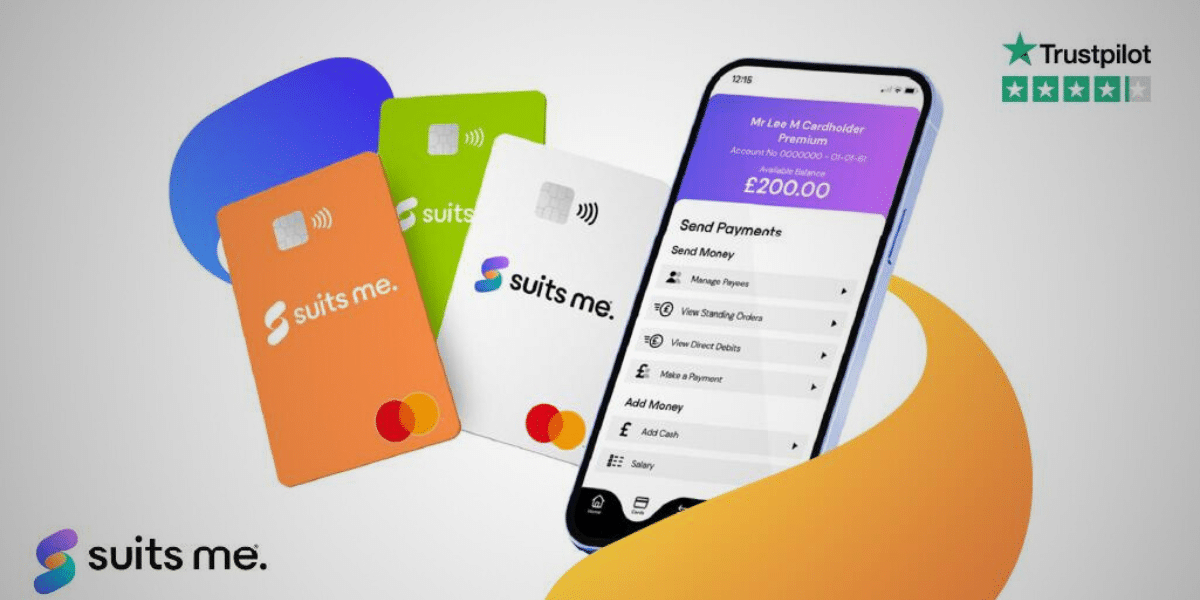

Suits Me® addresses the issue of financial exclusion in the UK by offering banking services tailored to those often underserved by traditional banks. It provides various financial services without requiring a credit check or proof of a current UK address. This approach enhances accessibility, making Suits Me® a practical option for individuals who might otherwise lack banking support.

Features of Suits Me® Accounts

- Direct Debit Facilities: One of the key features of Suits Me® accounts is the ability to set up direct debits. This facility allows customers to benefit from discounts and better rates that are typically reserved for those who can pay via direct debit. It also helps in managing regular payments efficiently.

- Savings Envelopes: Suits Me® offers digital savings envelopes, a feature that allows users to set aside money for future use. This tool helps customers budget and save, promoting financial stability and resilience.

- Instant Access to Funds: With Suits Me®, customers can access their funds instantly. There are no overdraft facilities, meaning users can only spend what they have, which helps in avoiding debt and managing finances responsibly.

- No Credit Check Required: Traditional banks often require credit checks, which can be a barrier for many. Suits Me® eliminates this hurdle, making it easier for individuals with poor credit or no credit history to open an account.

- Comprehensive Online and Mobile Banking: Suits Me® provides an online banking platform and a mobile banking app, enabling customers to manage their accounts conveniently. This digital access ensures that banking services are available at their fingertips, regardless of location.

Photo Courtesy: suits me

Addressing the Needs of the Underbanked

Suits Me® is dedicated to addressing the needs of the underbanked population in the UK. By offering an inclusive banking solution, Suits Me® helps individuals overcome the barriers that prevent them from accessing essential financial services. This commitment to financial inclusion is evident in the practical features and benefits provided to customers.

Real-Life Impact

Opening a Suits Me® account can be highly beneficial, particularly for individuals who might struggle with traditional banking barriers. For example, a migrant worker without a current UK address or a credit history often faces difficulties in securing banking services. Traditional banks might not cater to their needs, but Suits Me® provides an alternative. By setting up a Suits Me® account, such individuals can manage their finances more effectively, receiving wages, paying bills via direct debit, and organizing savings with digital envelopes. This service facilitates easier integration into the financial system, supporting greater financial stability.

The Broader Picture

While Suits Me® is making significant strides in addressing financial exclusion, there is still work to be done. The existence of 1.2 million underbanked individuals highlights the need for ongoing efforts to increase financial inclusion. Governments, financial institutions, and fintech companies must continue to collaborate and innovate to ensure that everyone has access to the banking services they need.

Financial exclusion remains a significant issue in the UK, affecting millions of individuals and imposing a financial burden known as the banking poverty premium. Suits Me® addresses this challenge by offering accessible, inclusive banking solutions that cater to the needs of the underbanked population. Through features like direct debit facilities, digital savings envelopes, and no credit check requirements, Suits Me® provides a lifeline for those who struggle to access traditional banking services. By continuing to innovate and prioritize inclusivity, Suits Me® plays a crucial role in promoting financial stability and empowerment for all.

Disclaimer: “This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.”

Published by: Nelly Chavez