Navigating the property market as a first-time buyer in the UK today presents a unique set of challenges, largely due to the stringent mortgage lending criteria established in the aftermath of the 2008 financial crisis. These regulations, though designed to fortify the economy, inadvertently erected barriers for newcomers eager to step onto the property ladder. The need for reform in mortgage lending practices is palpable, aiming to dismantle these barriers and foster a more inclusive market for first-time purchasers.

A Closer Look at Current Mortgage Practices

The landscape of mortgage lending has undergone significant transformations since the financial downturn of 2008. In an effort to avert a repeat of the crisis, regulatory bodies implemented strict lending criteria. These measures, while successful in stabilizing the market, have also made it increasingly difficult for first-time buyers to secure financing.

The Building Societies Association (BSA) has highlighted this issue, noting a marked decline in mortgages granted to first-time buyers. This decline is attributed to the stringent affordability and repayment criteria that do not account for the financial realities faced by many potential homeowners today.

The BSA advocates for a significant revision of the current mortgage lending criteria. Their proposal includes the introduction of more versatile mortgage offerings, such as plans that combine elements of repayment and interest-only loans. These innovative mortgage strategies could be tailored over the loan period, offering a lifeline to those with limited, fluctuating, or lower-than-average incomes. Such reforms would not only make homeownership more accessible but also reflect a more nuanced understanding of modern financial realities.

The Path Forward: Balancing Risk and Accessibility

The call for reform is not about reverting to the lax lending standards of the past but finding a middle ground that ensures financial stability while making homeownership achievable for first-time buyers. Mortgage specialist Chris Sykes echoes this sentiment, emphasizing the need for adaptable mortgage solutions that can alleviate the initial financial strain on new homeowners. The role of regulatory bodies is crucial in facilitating these changes, ensuring that the market evolves in a way that is both responsible and responsive to the needs of first-time buyers.

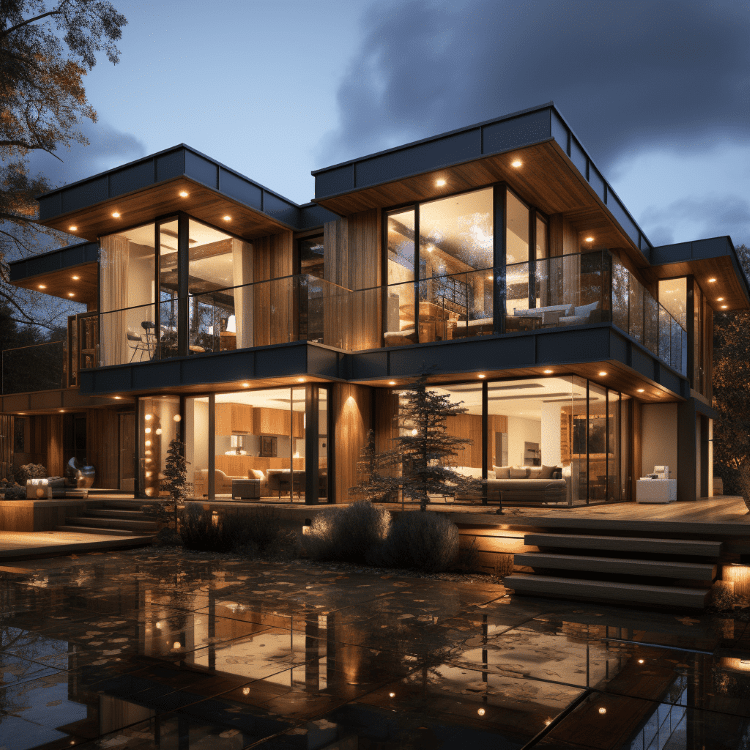

New builds in East London represent a significant opportunity for first-time buyers, provided that the mortgage lending criteria evolve to support their aspirations. The development of these projects hinges on the ability of buyers to secure financing, underscoring the broader impact of mortgage lending reforms on the property market as a whole. Here is a great example – a personal experience of investing in real estate in Canary Wharf. It is one of the promising neighborhoods in East London.

The journey towards homeownership in the UK is at a pivotal juncture. The proposed reforms in mortgage lending practices offer a beacon of hope for first-time buyers. By recalibrating the balance between risk and accessibility, the UK can foster a property market that is both robust and inclusive, ensuring that the dream of homeownership is within reach for a new generation of buyers.

What’s going on with mortgage rates in the UK right now

The Mortgage Works, part of the Nationwide Building Society family, has just made a move that’s got a lot of folks talking. They’ve decided to cut their buy-to-let mortgage rates. And this isn’t about tiny snips here and there. Some of these cuts go as deep as 0.85%. For those looking to switch their buy-to-let mortgages, things just got a bit more interesting.

Here’s the lowdown: if you’re sitting on a buy-to-let property and thinking about your mortgage options, The Mortgage Works has dropped a 2-year fixed rate to 4.99%. That’s with a 3% fee, aimed at loans up to 55% of the property’s value. They didn’t stop there, though. A 3-year fixed rate? Down to 5.3% for loans up to 65% LTV, marking a 0.70% reduction. And for the long-term planners, a 5-year fixed rate now sits at 5.3%, with a 3% fee for loans covering up to 75% LTV, showing a decrease of 0.4%.

But wait, there’s more. They’ve also introduced a 10-year fixed rate at 5.5%, with a £1,495 fee for up to 75% LTV, trimming down by 0.45%. And for those who like to keep things a bit more flexible, there’s a 2-year tracker rate now at 5.04%, with a 3% fee for up to 65% LTV, slightly reduced by 0.05%.

What does all this mean? Simply put, The Mortgage Works is throwing a lifeline to existing customers, helping them navigate their finances a bit more smoothly with these competitive rates. It’s a clear signal that they’re committed to supporting their customers, making it a tad easier for landlords to manage their new properties without breaking the bank.

Published by: Martin De Juan